Call Us Today (801) 794-5094

10 Reasons Why Lenders Lack Compliant Oversight of AMC’s

Top 10 Reasons |

why lenders lack compliant oversight of AMC's * |

- 1. Lack of an organized and written plan for AMC oversight

- 2. Lack or inadequate knowledge of appraisal management company individual state laws, individual state appraiser board requirements; and federal/GSE regulations that apply to AMC’s and that create lender accountability for each AMC’s adherence

- 3. Lack of adequate lender in-house resources necessary for AMC oversight

- 4. Lenders’ perception of high cost in dollars and dedicated staff time

- 5. Incomplete due diligence performed in AMC onboarding & contract renewal

- 6. Inadequate Service Level Agreement development covering critical AMC performance

- 7. Incomplete usage of crucial AMC performance and compliance metrics

- 8. Lack or inadequate ongoing AMC regulatory compliance monitoring of adherence to individual state laws and state appraiser board requirements; federal, GSE and lender specific rules; and documentation and reporting of monitoring results

- 9. Lack or inadequate lender appraiser selection policies including testing and documentation for proper appraiser experience, expertise, education, goodstanding, and acceptable background verification

- 10. Lack or inadequate policies and procedures to periodically test USPAP competency of all appraisers performing appraisals and reporting violations to the specific state appraiser board directly and/or by the AMC

* One or more of these top 10 reasons are common to many mortgage lenders. This is not designed to be a comprehensive list of all critical issues concerning third party oversight of appraisal management companies.

How important is AMC oversight?

Short answer...critical. Adequate lender oversight of valuation vendors can be daunting due to the vast overlay of federal and individual state requirements, but the mandate from regulators asserts that while valuation services can be outsourced, lender accountability and liability cannot.

CFPB...Agencies...Fannie Mae Speak Out

“An institution is accountable for ensuring that any services performed by a third party, both affiliated and unaffiliated entities, comply with applicable laws and regulations and are consistent with supervisory guidance. Therefore an institution should have the resources and expertise necessary for performing oversight of third party arrangements.

An institution should have internal controls for identifying, monitoring, and managing the risks associated with a third party arrangement for valuation services, including compliance, legal, reputational and operational risks.” Interagency Appraisal and Evaluation Guidelines 12/2/2010

“The CFPB expects supervised banks and nonbanks to have an effective process for managing the risks of service provider relationships. The CFPB will apply these expectations consistently, regardless of whether it is a supervised bank or nonbank that has the relationship with a service provider.” CFPB Bulletin 2012-2013

“If a Lender enters into a contract with any vendor, contractor, or third-party service provider, the lender is accountable for the quality of the work as if was performed by an employee of the Lender.” Fannie Mae Selling Guide B4-1.1.03 Appraiser Selection Criteria 01/27/2015

Interagency Appraisal and Evaluation Guidelines

The Interagency Appraisal and Evaluation Guidelines are a primary source for the scope of oversight needed for third-party valuation vendors. Due diligence, resources, expertise, contracting, internal controls, monitoring, periodic assessment, and total compliance to all applicable federal and state laws are discussed.

Interagency Appraisal and Evaluation Guidelines

XVI. Third Party Arrangements

An institution that engages a third party to perform certain collateral valuation functions on its behalf is responsible for understanding and managing the risks associated with the arrangement. An institution should use caution if it engages a third party to administer any part of its appraisal and evaluation function, including the ordering or reviewing of appraisals and evaluations, selecting an appraiser or person to perform evaluations, or providing access to analytical methods or technological tools.

An institution is accountable for ensuring that any services performed by a third party, both affiliated and unaffiliated entities, comply with applicable laws and regulations and are consistent with supervisory guidance. Therefore, an institution should have the resources and expertise necessary for performing ongoing oversight of third party arrangements.

An institution should have internal controls for identifying, monitoring, and managing the risks associated with using a third party arrangement for valuation services, including compliance, legal, reputational, and operational risks. While the arrangement may allow an institution to achieve specific business objectives, such as gaining access to expertise that is not available internally, the reduced operational control over outsourced activities poses additional risk. Consistent with safe and sound practices, an institution should have a written contract that clearly defines the expectations and obligations of both the financial institution and the third party, including that the third party will perform its services in compliance with the Agencies’ appraisal regulations and consistent with supervisory guidance.

If an institution outsources any part of the collateral valuation function, it should exercise appropriate due diligence in the selection of a third party. This process should include sufficient analysis by the institution to assess whether the third party provider can perform the services consistent with the institution’s performance standards and regulatory requirements. An institution should be able to demonstrate that its policies and procedures establish effective internal controls to monitor and periodically assess the collateral valuation functions performed by a third party.

An institution also is responsible for ensuring that a third party selects an appraiser or a person to perform an evaluation who is competent and independent, has the requisite experience and training for the assignment, and thorough knowledge of the subject property’s market. Appraisers must be appropriately certified or licensed, but this minimum credentialing requirement, although necessary, is not sufficient to determine that an appraiser is competent to perform an assignment for a particular property or geographic market. An institution’s risk management system should reflect the complexity of the outsourced activities and associated risk. An institution should document the results of ongoing monitoring efforts and periodic assessments of the arrangement(s) with a third party for compliance with applicable regulations and consistency with supervisory guidance and its performance standards. If deficiencies are discovered, an institution should take remedial action in a timely manner.

A List of Other Federal, State & GSE Requirements

CFPB- Bulletin 2012-03 ‘Service Providers; Bulletin 2013-06 ‘ Responsible Business Conduct: Self Policing, Self Reporting, Remediation, and Cooperation

OCC- OCC Bulletin 2013-29 ‘Third Party Relationships’

NCUA- NCUA Letter No.: 07-CU-13 ‘Supervisory Letter-Evaluating Third Party Relationships’; Ltr: 08-CU-09 ‘Third Party Relationships Questionaire’

FDIC- FDIC FIL 44-2008 Guidance for Managing Third-Party Risk

FFIEC- Interagency Appraisal and Evaluation Guidelines 12-10

Title XI FIRREA- Real Estate Reform [12 U.S.C. 3331-3351] as amended by the Dodd Frank Act

OIG/Dept of the Treasury- OIG-14-034 ‘OCC’s Review of Banks’ Use of Third Party Service Providers Is Not Sufficiently Documented’

Multi-State Mortgage Committee (CSBS-AARMR) - MMC Mortgage Examination Manual

Interagency(Dept Treasury; Federal Reserve; FDIC; NCUA; FHFA; CFPB) - Minimum Requirements for Appraisal Management Companies; OCC; FRB; FDIC; OTS; NCUA - Interagency Appraisal and Evaluation Guidelines

FNMA- Selling Guide Jan 27, 2015; Appraiser Quality Monitoring FAQ’s July 2014; Appraiser Quality Monitoring Notice Jan 6, 2014

HUD- Mortgagee Letter 09-28

State Appraiser Boards - All States including laws from: AL-SB320, AZ-SB1351, AK-AMCS, CA-SB237, CO- HB 12-1110, CT-PA10-77, FL-HB-303 , GA-HB1050, IL-HB 2956, IN-HA1235, KS-SB-345, KY-HB 288, LA-HA1235, MA-H 124, MI- HB 4975, MD-HB102, MN- SF2510, MO-HB1692et.al, MS- HB1337, MT – HB 188, NE- LB410, NV-AB287, NH- SB153, NJ- ASM 3827, NM-AMC1022, NC-SB 829, OH-HB515, OK- HB2772, OR-HB3624, PA-HB 398, SC-H.3717, TN-PC963, TX-HB1146, UT-HB152 & T61Chap2(e), VT-N103 ,VA-C508 & WA-HB3040.

State Requirements for AMC’s are Vast & Growing

Compounding the oversight challenge is the enormous growing mass of state laws and state appraisal board regulations and rules. Currently, AMC’s have the greatest risk of non-compliance at the individual states’ level. At the core of state compliance is the requirement for USPAP competency of all active appraisers.The primary method for testing USPAP competence is the Standard 3 USPAP Compliance Review. Below are some of the states’ specific requirements for USPAP reviews.

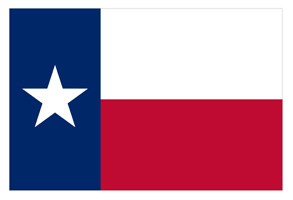

TX Appraiser Licensing & Certification Board

Texas Annual USPAP “2% Rule” & Certification

State Requirement: USPAP Standard 3 Compliance Review of 1 of first 5 appraisals for each new Texas appraiser and annual USPAP Standard 3 reviews based on random selection of 2% of AMC's rolling 12 month production cycle (Texas AMC Compliance Rule 22 1104). Reviewers must be TX licensed or certified according to TX Rule 22 -1104.

CO Board of Real Estate Appraisers

Colorado Annual AMC USPAP Compliance Review “DOUBLE Rule” & Declaration

State Requirement: USPAP Standard 3 Compliance reviews per year per each Colorado appraiser (2 for each appraiser per year) on AMC panel with random sampling of original appraisals (AMC Compliance Rule 4 CCR 725-2).

KS Real Estate Appraisal Board

Kansas Annual AMC USPAP Compliance Review '5% Yearly' & Certification

State Requirement: Minimum of 1 USPAP Standard 3 Compliance review per Kansas appraiser per year or 5% of all appraisals per appraiser per year (Whichever is greater) (KS AMC Registration Act 58-4704 Rules/Regs 117-20-7). Reviewers must be Kansas licensed or certified according to KS Act 58-4704

NC Appraisal Board

North Carolina Annual AMC USPAP Compliance '5% Rule' & Declaration

State REquirement: Minimum of 1 USPAP Standard 3 Compliance review per North Carolina appraiser per year or 5% of all appraisals per appraiser per year (whicherver is greater). (North Carolina AMC Rules Subchapter 57D .0306.)

NM Real Estate Appraisers Board

New Mexico Annual AMC USPAP Compliance '5% Rule' & Certification

State Requirement: Minimum of 1 USPAP Standard 3 Compliance review per New Mexico appraiser per year or 5% of all appraisals per appraiser per year (Whichever is greater) (New Mexico AMC Reqs 47:14/Employee In Charge Req 16.65.2.11) USPAP Reviewers must be same License Level as Original NM Appraiser per NM Title 16.65

MT Board of Real Estate Appraisers

Montana AMC USPAP Compliance 'Annual' & Compliance Confirmation

State Requirement: Minimum of 1 USPAP Standard 3 Compliance review per Montana appraiser per year. Validox: Higher volume appraisers may require additional reviews. (Montana Appraiser Board AMC Compliance Code 37-54-511). USPAP Reviewers must be Montana Licensed or Certified per MT House Bill 188 - 8

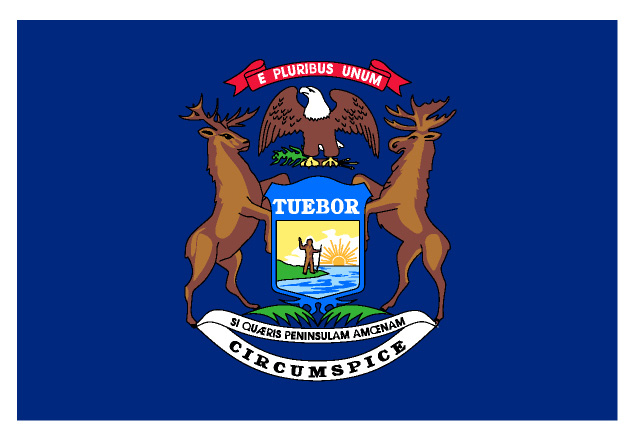

MI State Board of Real Estate Appraisers

Michigan AMC 'Annual Certification' of USPAP Compliance

Annual Certification of System in Place to ensure Appraiser Panel in compliance with USPAP (Michigan AMC Act 505 Article 26) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per MI appraiser per year or 5% of higher volume appraiser production. USPAP Reviewers must be Certified or General Licensure per MI Act 505

OK Real Estate Appraiser Brd

Oklahoma Annual AMC USPAP Compliance 'Statistically Significant' Rule & Declaration

(Oklahoma AMC Regulation Act Section 858 804) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per OK appraiser per year or 5% of higher volume appraiser production. USPAP Reviewers must be Oklahoma Licensed or Certified per OK AMC Act § 858-813

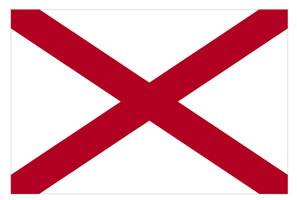

AL Real Estate Appraisers Board

Alabama AMC Annual USPAP Compliance Certification Compliance Rule

(Alabama AMC Code Title 34, Section 34-27) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per AL appraiser per year or 5% of higher volume appraiser production. USPAP Reviewers must be Alabama Licensed or Certified per AL Code Title 34 - 27A

CA Bureau of RE Appraisers

California AMC USPAP Compliance Review 'Reasonable Procedures' Rule & Certification

(California SB 237 Chapter 173:3577 Minimum Standards of Practice for Appraisal Management Companies) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per CA appraiser per year or 5% of higher volume appraiser production.

CT Real Estate Appraisal Commission

Connecticut AMC SB 13-2 USPAP Compliance Review Rule & Confirmation

(Connecticut SB 13 Section 2 c: AMC Review Procedures) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per CT appraiser per year or 5% sampling of higher volume appraiser production. Validox Recommends USPAP Reviewers be Connecticut Licensed/Certified per CT SB 13

GA RE Comm & Appraisers Brd

Georgia Annual AMC USPAP Compliance 'System' and Procedures Rule & Certification

(Georgia Appraisal Management Company House Bill 1050: Section 4(H)) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per GA appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Georgia Licensed or Certified per GA HB 1050

IL Division of Real Estate

Illinois Annual AMC 'USPAP Review System' Certification Requirement

(Illinois AMC Administrative Code 225 ILCS 459 Section 40) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per IL appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Illinois Licensed or Certified per IL Admin Code 1452.130

KY Real Estate Appraisers Board

Kentucky Annual AMC USPAP Compliance 'System & Process' & Certification

(Kentucky Appraisal Management Company House Bill 13 RS HB 120-KRS Chapter 324) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per KY appraiser per year or 5% sampling of higher volume appraiser production. Validox Recommends USPAP Reviewers be Kentucky Certified or General per KY 201 30:360

LA Real Estate Appraisers Board

Louisiana Annual AMC “Adherence to Standards' USPAP Compliance & Declaration

(Louisiana Appraisal Management Company Licensing and Regulations Act Chapter 51-A §3415.13) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per LA appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Louisiana Certified or General per LA AMC Act 51-A

MD Comm of Real Estate Appraisers

Maryland Annual AMC USPAP Compliance Certification and Renewal Confirmation

(Maryland Appraisal Management Company Licensing and Regulations Act SB 658 Section16) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per MD appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Maryland Licensed or Certified per MD SB 658 Section 16

MN Department of Commerce

Minnesota Annual AMC USPAP Compliance Review Certification

(Minnesota Appraisal Management Company Licensing and Regulations Act Statute 82C Subd. 5-8) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per MN appraiser per year or 5% sampling of higher volume appraiser production.

MO Real Estate Appraisers Commission

Missouri AMC USPAP Compliance 'System' Rule & Confirmation

(Missouri Appraisal Management Company Licensing and Regulations Act 20 CSR 2245- 10.010 -.030) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per MO appraiser per year or 5% sampling of higher volume appraiser production.

PA State Board of Certified Real Estate Appraisers

Pennsylvania AMC Minimum Standards USPAP Compliance 'System'

(Pennsylvania Appraisal Management Company Licensing and Regulations 49 PA. Code Chapter 36 Section 431-432) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per PA appraiser per year or 5% sampling of higher volume appraiser production.

SD Department of Labor & Regulation

South Dakota Annual AMC USPAP Review Compliance 'System' and Confirmation

(South Dakota AMC Licensing and Regulations South Dakota Codified Law 36-21D & Rule 20:77) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per SD appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be South Dakota Licensed or Certified per SD Article 20:77

TN Real Estate Appraisers Comm

Tennessee AMC USPAP Review Quality Control 'System' & Reporting Requirement

(Tennessee Appraisal Management Company Licensing and Regulations TN HB 3191 § 62- 39-104) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per TN appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Tennessee Licensed or Certified per TN HB 3191 Section 14

WA RE Appraiser Comm

Washington AMC USPAP Review 'Adherence to Standards' & Internal Controls Certification

(Washington Appraisal Management Company Requirements Section 18.310.060) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per WA appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Washington Licensed or Certified per RCW 18:310

WY Real Estate Appraisers Comm

Wyoming Annual AMC USPAP Review 'System' & Adherence Certification

(Wyoming Appraisal Management Company House Bill HB 26 Section 33-39-215) Validox Recommendation: Minimum 1 USPAP Standard 3 Compliance review per WY appraiser per year or 5% sampling of higher volume appraiser production. USPAP Reviewers must be Wyoming Certified or General per WY Act 91 Section 33

Alaska (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Arkansas State AMC Requirements

Arizona State AMC Requirements

Delaware State AMC Requirements

Florida State AMC Requirements

Hawaii (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Iowa (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Idaho (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Indiana State AMC Requirements

Massachusetts (State Pending Legislation/Rules)

Maine (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Mississippi State AMC Requirements

North Dakota State AMC Requirements

Nebraska State AMC Requirements

New Hampshire State AMC Requirements

New Jersey (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Nevada State AMC Requirements - USPAP Reviewer must be NV licensed or certified appraiser

New York (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Ohio (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Oregon State AMC Requirements

Rhode Island (Federal Minimum AMC Rules or State Pending Legislation/Rules)

South Carolina (Federal Minimum AMC Rules or State Pending Legislation/Rules)

Utah State AMC Requirements

Virginia State AMC Requirements

Vermont State AMC Requirements

Wisconsin (Federal Minimum AMC Rules or State Pending Legislation/Rules)

A Sampling of Other State Rules

For illustration purposes only, a few rules from certain states are highlighted to give a brief overview of the types of rules and requirements endemic to many state compliance demands. Listed are a few highlights from Alabama, Colorado, Illinois, North Carolina and Texas.

Alabama

Require all appraisers and reviewers have geographic competency for assignments, and prior to addition to panel, require a written declaration of competency that must be updated annually Review a representative sample of each independent appraiser's reports on a periodic basis to verify accordance with USPAP and law and maintain records for 5 years Maintain a dispute resolution process to allow users of a report to request that the appraiser consider additional information, provide further detail, substantiation, or explanation for the appraiser's value conclusion, or correct errors Anyone with involvement in the performance of appraisal services or review and analysis of appraisals shall be an AL appraiser (license classification shall qualify employee to perform all applicable job functions) Require confirmation of competency in writing prior to placing assignment Must pay an appraiser with 45 days of receipt of completed appraisal, except in cases of a mutually agreed upon payment date, breach of contract, or violation of USPAP – must notify appraiser in writing, stating details and dispute process, within 30 days if AMC decides not to pay the appraiser

Colorado

Exercise due diligence when hiring or engaging a real estate appraiser to ensure that the real estate appraiser is appropriately credentialed by the board and competent to perform the assignment Verify that the work completed by an appraiser complies with state and federal regulations, including USPAP, by conducting an annual audit of a random sample of the appraisals received within the previous year – not less than 2 standard 3 reviews for each appraiser Must have a written policy in place – note effective date and dates any changes are made. Policy must outline: appraisal selection, riskbased reviews, review criterion, reviewer qualifications, and appraisal deficiencies (See 4 CCR 725-2; Chap. 18 for more detail) Pay an appraiser within 60 days after completion of the appraisal, unless otherwise agreed or the appraiser has been notified in writing of a bona fide dispute Maintain for 5 years, or 2 years after judicial proceedings, documents/records directed by the Board, including: contractual agreements and engagement documents, correspondence, appraisals and supporting documentation, appraiser panel (See 4 CCR 725-2; Chap. 18 for more detail) – may be stored electronically Disclose to client the fee paid to the appraiser upon completion of the assignment

Illinois

Appraisers and reviewers (other than QC) must be licensed in Illinois – have process to verify Process to utilize Illinois appraiser to review the work of all appraisers performing appraisal services in Illinois for the AMC on a periodic basis, except for a QC review, to verify accordance with USPAP Maintain for 5 years from final action or end of litigation, a detailed record of each service request and performing appraiser [See Rule 1452.90 for details] Employees directly involved in providing appraisal management services must be appropriately trained and familiar with the appraisal process Compliance with TILA 129E, including customary and reasonable fees Not interfere with appraiser's adherence to USPAP or law Payment policies shall be written and definitive in nature and be provided to appraiser [See Rule 1452.100 for details that must be included] In the event of a value dispute or a requested reconsideration of value, the AMC shall deliver all information that supports an increase or decrease in value to the appraiser Notify the Department within 30 days any change in reported controlling person information [including discipline], within 15 days of a change in mailing, email, or website address May not remove an appraiser without prior written notice, stating reasons, not less than 30 days prior to removal from the AMC's list of approved vendors Must notify Board within 30 days of appraiser removal for a violation of the law/USPAP For each assignment provide: written guidelines and conditions; and within engagement documents: AMC registration number and expiration date, property location and type, total compensation, turn time requirements, AMC representative contact info, contact info for person providing access to property, sales contract/addenda, AMC/client guidelines, whether property owner advised interior images may be required, end-user client

Appraiser Prompt-Payment Rule

Another critical AMC compliance rule in most states is the prompt payment deadline for independent appraisers.The deadlines range from 30 to 60 days depending on the state. Stiff non-compliance penalties apply.

North Carolina

Before appraiser is added to panel, require appraiser to declare in writing areas of geographic, property type, and methodology competency. Require appraiser to update this information at least annually, and keep copies of all such declarations for a period of 5 years from submission Periodically review the work of all independent appraisers to ensure accordance with USPAP – may choose a representative sample of each appraiser's reports. Must review each appraiser's work at least once a year, and keep records of reviews for a period of 5 years from the date they are done. Designate a Compliance Manager, an actively certified appraiser in any state, responsible for notifying the Board of any changes in registration of any assumed name or contact info, maintenance of records relating to appraisals and all appraisers on panel in NC, including a log of payments to appraisers, and the conduct of advertising of appraisal management services on behalf of AMC Must report an appraiser's violation of law or USPAP or unethical conduct to the Board within 90 days of appraisal submission to AMC Payment is due to appraisers within 30 days. If AMC will not pay a fee to an appraiser for an appraisal, must notify the appraiser in writing of the reason for nonpayment within 30 days after the date the appraiser transmits the appraisal (See 21 NCAC 57D .0310 Payment of Fees to Appraisers) May not remove an appraiser without prior written notice, stating reasons. Must send notice registered mail and notify of any dispute resolution process

Texas

Must follow Rule 159.161 in adding to/maintaining appraiser panel Primary Contact must be a certified appraiser in at least one state or have completed the 15 hour USPAP course and 7 hour update course not more than 2 years before renewal of registration May not employ or contract with a person/entity (who employs a person) to order or review appraisals who has had a license revoked/denied in any state, unless subsequently reinstated Verify appraisers are licensed in TX and not had license revoked/denied since last assignment Obtain written cert. for appraisal, at time of/prior to making assignment, of: (1) USPAP competency (prop. type, geo. area, access to appropriate data sources), (2) agreement to notify AMC if later determined not qualified, (3) aware misrepresentation of competency is subject to mandatory reporting req. Establish a dispute resolution process for appraisers providing for written response, written statement of outcome, copies of all relevant documentation to appraiser, and review Reviewers must have at least same licensure in TX as required to perform the assignment Periodically review the work of appraisers - performed on 1-4 family unit properties collateralizing mortgage obligations to ensure USPAP compliance (1 of first 5 appraisals, prior to assigning 6th and a randomly selected 5% of all appraisals every 12 mo.) See details in Rule 159.155. (Consider review findings in verifying competency for the purpose of assigning appraiser future work) Maintain for 5 years a record of each service request, performing appraiser, compensation policy, and a written record of all substantive communications between an AMC and appraiser relating to inclusion on an appraiser panel or to an appraisal assignment Pay appraiser at customary/reasonable rate within 60 days of providing completed appraisal to AMC

We believe that there are 4 key areas in an effective and sufficient third party oversight program for appraisal management companies. Most of the issues that create risk for the lender can be assigned as a risk or compliance concern of one of the 4 key areas.

4 Key Areas of AMC Oversight

- Initial AMC Approval Due Diligence and Appropriate Service Level Agreement (SLA)

- Periodic and/or Annual AMC Review and SLA Renewal

- Understanding and Use of Crucial AMC Performance and Compliance Metrics

- Frequent - Consistent AMC Performance and Compliance Reporting

An oversight program for AMC’s must be based on laws, regulations and rules that directly impact the lender as the responsible party for AMC third party performance and compliance.These requirements are both growing and evolving, but the following constitute a solid foundation for an adequate program.

CFPB- Bulletin 2012-03 ‘Service Providers; Bulletin 2013-06 ‘ Responsible Business Conduct: Self Policing, Self Reporting, Remediation, and Cooperation OCC- OCC Bulletin 2013-29 ‘Third Party Relationships’ NCUA- NCUA Letter No.: 07-CU-13 ‘Supervisory Letter-Evaluating Third Party Relationships’; NCUA Ltr: 08-CU-09 ‘Third Party Relationships Questionaire’ FDIC- FDIC FIL 44-2008 Guidance for Managing Third-Party Risk FFIEC Interagency Appraisal and Evaluation Guidelines 12-10 Title XI FIRREA- Real Estate Reform [12 U.S.C. 3331- 3351] as amended by the Dodd Frank Act OIG/Dept of the Treasury- OIG-14-034 ‘OCC’s Review of Banks’ Use of Third Party Service Providers Is Not Sufficiently Documented’ Multi-State Mortgage Committee (CSBSAARMR) - MMC Mortgage Examination Manual Interagency(Dept Treasury; Federal Reserve; FDIC; NCUA; FHFA; CFPB) - Minimum Requirements for Appraisal Management Companies; OCC; FRB; FDIC; OTS; NCUA - Interagency Appraisal and Evaluation Guidelines FNMA- Selling Guide Jan 27, 2015; Appraiser Quality Monitoring FAQ’s July 2014; Appraiser Quality Monitoring Notice Jan 6, 2014 HUD- Handbook 4000.1 Individual State Appraiser Boards - All States including laws from: AL-SB320, AZ-SB1351, AK-AMCS, CA-SB237, CO- HB 12-1110, CT-PA10-77, FL-HB-303 , GA-HB1050, IL-HB 2956, IN-HA1235, KS-SB-345, KY-HB 288, LA-HA1235, MA-H 124, MI- HB 4975, MD-HB102, MNSF2510, MO-HB1692et.al, MS- HB1337, MT – HB 188, NE- LB410, NV-AB287, NH- SB153, NJASM 3827, NM-AMC1022, NC-SB 829, OH-HB515, OK- HB2772, OR-HB3624, PA-HB 398, SCH.3717, TN-PC963, TX-HB1146, UT-HB152 & T61Chap2(e), VT-N103 ,VA-C508 & WA-HB3040. And all other in-process state AMC registration acts and rules.

The 4 Key Areas focus on the significant risk areas for the Lender. Listed here are some of the more specific overall expectations and risk areas associated with each of the key areas.

Initial AMC Approval Due Diligence & SLA Contracting

1Third Party Expectations and Risk Areas Include:

Financial Stability

Reputation

Compliance - Federal, GSE, State, Appraiser Fee Panel

Business Continuity

Information Security

Appraiser Payment History

Appraiser Panel Due Diligence & Monitoring

Lender Specific Requirements

Appropriate Lender-AMC SLA Execution Reputation

Periodic/Annual AMC Review & SLA Renewal

2Third Party Expectations and Risk Area Reviews Include:

Financial Stability

Reputation

Compliance - Federal, GSE, State, Appraiser Fee Panel

Business Continuity

Information Security

Appraiser Payment History

Appraiser Panel Due Diligence & Monitoring

Lender Specific Requirements

Appraiser Quality, Timeliness and other Key Performance Issues

Appraisal Quality, Timeliness and other Key Performance Issues

Initial AMC Approval Due Diligence & SLA Contracting

3Third Party Expectations and Risk Area Reviews Include:

All Pertinent Laws, Rules and Regulations from:

CFPB

FHFA

Interagency

HUD

NCUA

Treasury Dept

OCC

FHLMC

FFEIC

State AMC Appraiser Board Rules

FDIC

FNMA

Title XI FIRREA

State AMC Statutes

OCC

Frequent Consistent AMC Performance & Compliance Reporting

4Per Lender Requirements Reporting May Include:

Current AMC Compliance - Federal, GSE, State, Appraiser Fee Panel

Current Appraiser Payment History

Current Appraiser Panel Due Diligence & Monitoring

Lender Specific Requirements for AMC Performance/Compliance

Quality, Timeliness and other Key Performance Issues

It’s important to understand that while Validox provides comprehensive and laser-focused AMC Oversight services to Lenders, our services are currently assisting the compliance efforts of many of the country’s top national and regional AMC’s. We work in tandem with the lender and their AMC partners in a collaborative and positive way to achieve total compliance for all parties

Key Areas of Third Party Oversight of AMC’s continue to evolve as additional laws and requirements develop. As with all compliance efforts, the most important step is the next.

Validox is pleased to provide any Lender with a no-obligation consultation to provide guidance in AMC oversight as well as help in identifying essential compliance requirements for those Lenders not using appraisal management companies.

Whether you decide to tackle all or part of AMC Oversight in-house or through outside methods, Validox can fill in the gaps with services and products to bolster your valuation compliance efforts. Our services are surprisingly affordable and our commitment to compliance affordability is central to our company’s mission.

Our complete AMC Third Party Oversight program takes care of all four key areas identified in this report, whether it is initial due diligence, contracting, monitoring, reporting, etc.

Validox is the mortgage industry’s only company focused exclusively on valuation compliance and valuation vendor third party oversight management. Let us show you how we can assist you in your efforts.